Crypto Market Rebounds: Bitcoin Crosses $110K, Ethereum Hits $4K as Investor Confidence Strengthens

The cryptocurrency market has witnessed a significant rebound over the last 24 hours, marking one of the strongest surges of 2025. Bitcoin (BTC) has broken past the $110,000 mark, while Ethereum (ETH) continues to trade around $4,000, signaling a revival of investor optimism after weeks of market correction.

Image Source: The Economic Times Crypto News (October 2025)

Market Overview

According to CoinMarketCap, the global crypto market capitalization rose by 3.5% in the past 24 hours, reaching $3.28 trillion. The rally was fueled by improved investor sentiment, institutional accumulation, and easing macroeconomic pressures.

Analysts suggest that the rebound reflects growing confidence that the U.S. Federal Reserve will hold interest rates steady, potentially sparking renewed liquidity in digital assets.

“Bitcoin’s rally past $110,000 reflects market resilience and increasing institutional participation,” said financial strategist James Porter from FinEdge Analytics.

Key Drivers Behind the Rebound

- Institutional Investment:

Leading hedge funds and asset managers have resumed crypto accumulation, with data showing consistent inflows into Bitcoin ETFs and Ethereum-based funds. - Macroeconomic Stability:

Easing inflation and hints of future interest rate cuts by major central banks have improved investor risk appetite. - Technical Indicators:

Both Bitcoin and Ethereum broke through key resistance levels, triggering buying momentum among traders. - Global Adoption:

The rapid adoption of blockchain technology across finance and logistics sectors continues to boost investor trust.

Image Source: Pintu Crypto Blog (October 2025)

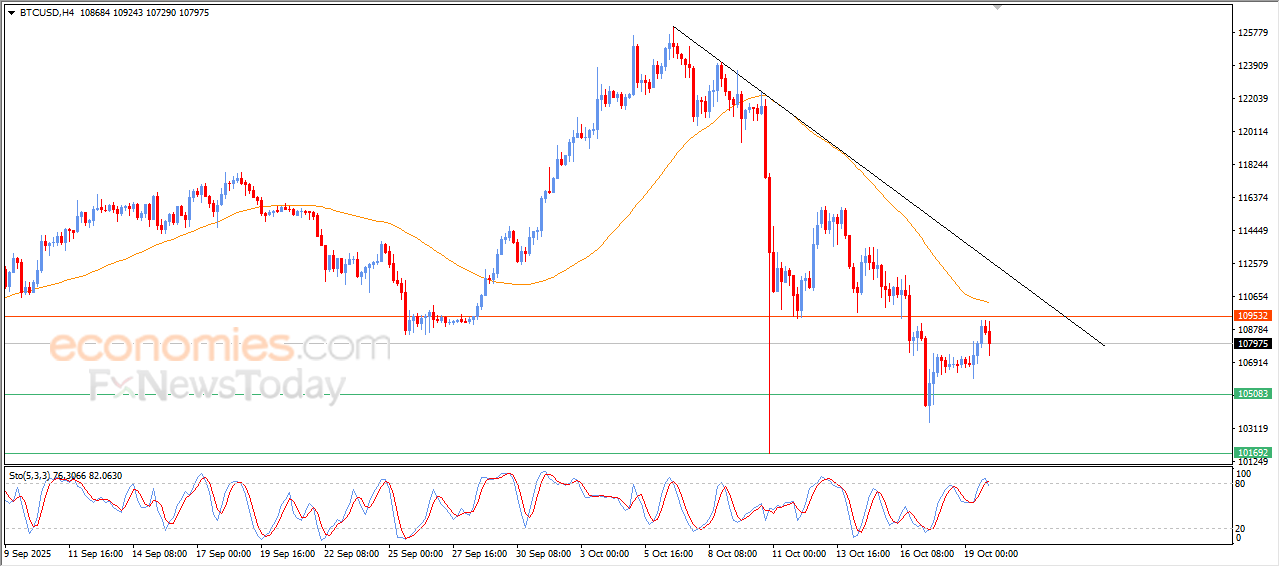

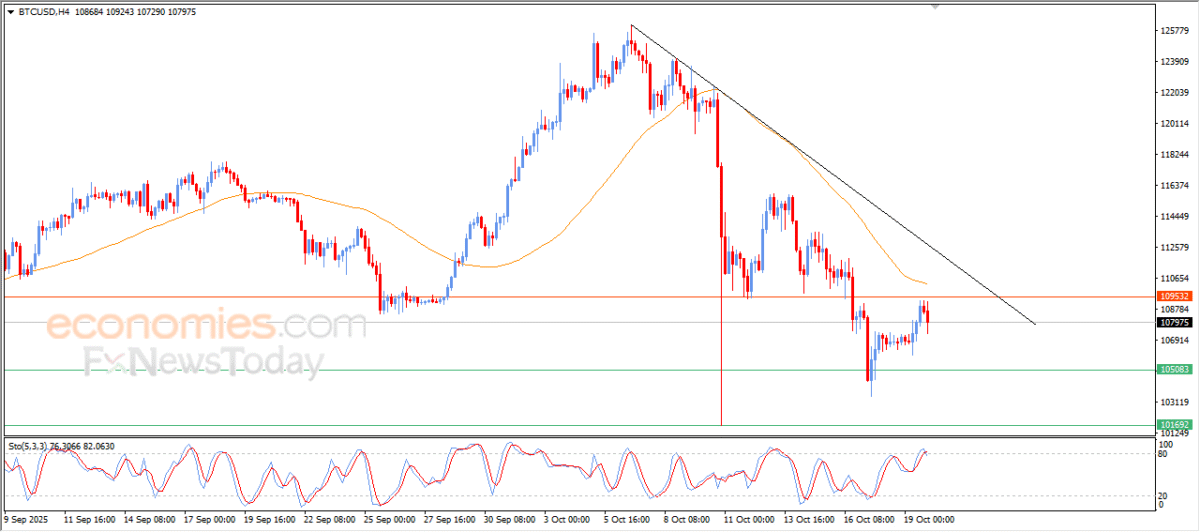

Bitcoin Crosses $110K: A Confidence Signal

Bitcoin’s move above $110K is seen as a psychological and technical milestone, reinforcing its role as a hedge against inflation and economic uncertainty.

Market analysts forecast Bitcoin could reach $115K–$118K if current momentum holds. Institutional sentiment remains positive, with several Wall Street firms increasing exposure to crypto-linked assets.

“Bitcoin is entering a sustainable growth phase,” noted Sarah Hughes, Senior Market Analyst at Crypto Wave Research. “Institutional demand is strengthening, and liquidity is returning across exchanges.”

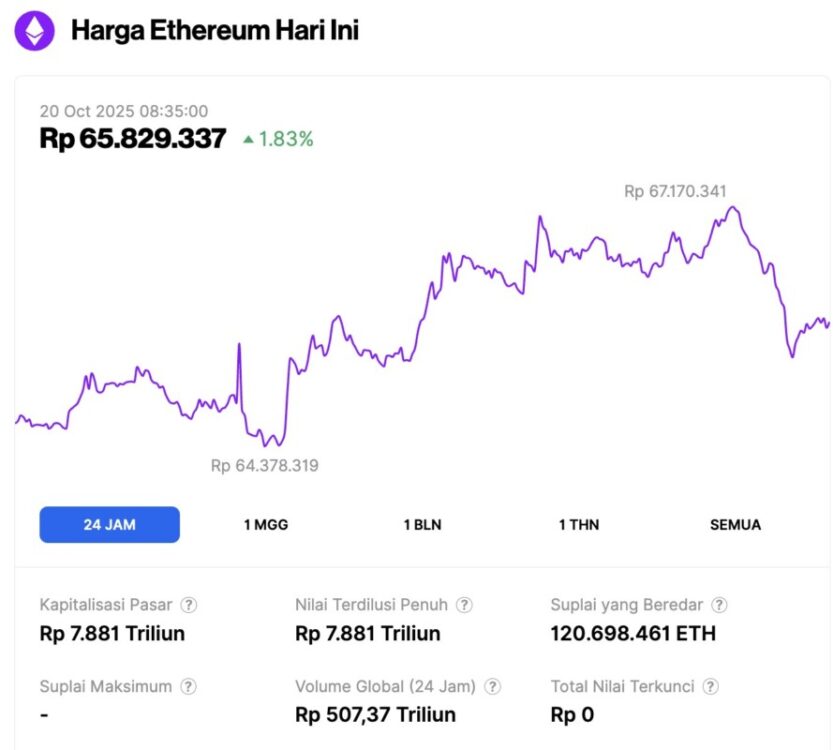

Ethereum Surges Past $4,000

Ethereum’s price surge is driven by renewed enthusiasm for DeFi (Decentralized Finance), NFT ecosystems, and Layer-2 networks. The recent upgrades to the Ethereum blockchain have improved scalability, helping sustain investor confidence.

Experts project that Ethereum could retest $4,300–$4,500 levels if gas fees continue to decline and staking rewards remain consistent.

Image Source: Crypto Quant Analysis (October 2025)

Altcoins Follow the Uptrend

Other major cryptocurrencies — including Solana (SOL), Ripple (XRP), and Polygon (MATIC) — recorded 2–4% daily gains. The AI and metaverse token categories also saw sharp increases as liquidity returned to the market.

Market experts, however, advise caution. The crypto market remains highly volatile, and investors are urged to manage risk carefully amid short-term price fluctuations.

Market Outlook 2025

Financial analysts predict that the next few months will be pivotal for digital assets as policymakers finalize upcoming crypto regulations in the U.S. and Europe.

If inflation remains under control and institutional adoption continues, Bitcoin could test $120K–$125K, while Ethereum might climb above $5K by early 2026.

Investor Insights

The ongoing crypto recovery has reignited optimism among long-term investors. Still, experts advise diversification and maintaining a balanced portfolio.

“Crypto is once again showing resilience,” said Alan Reese, Head of Strategy at Digital Wealth Insights. “The key now is sustainability — focusing on real utility and long-term adoption.”

About Market Financial Journal

Market Financial Journal delivers accurate and up-to-date reports on finance, investment, and global market movements. Our editorial mission is to provide reliable press releases and analytical insights that help readers make informed financial decisions.Contact Information

📩 Email:hammadyousaf355@gmail.com

🔗 LinkedIn:https://linkedin.com/in/m-hammad-yousaf-383705250