Crypto Market & Regulation Update (October 2025)

Crypto Market & Regulation Update (October 2025)

Introduction

The cryptocurrency market is experiencing a complex mix of regulatory, enforcement and trading-volatility signals this week that investors and traders cannot ignore. From global enforcement efforts against crypto-enabled crime to major liquidations in trading markets, the landscape is evolving rapidly.

Regulatory & Enforcement Headlines

One major event: the Europol-led 9th Global Conference on Criminal Finances & Cryptoassets (28-29 Oct 2025, Vienna) brought together regulators, law-enforcement agencies and industry stakeholders to tackle the rising threat of crypto-enabled crime. (Basel Institute on Governance)

Key take-aways:

- Enforcement agencies warn that crypto-related illicit activity is “increasingly sophisticated, complex and organised.” (DL News)

- A call for stronger international cooperation, shared standards and improved training among public and private sector actors. (Digital Watch Observatory)

- Participation of industry players (such as TRON DAO) demonstrating public-private collaboration. (CryptoSlate)

Why this matters

For investors and market watchers: regulation is no longer peripheral. Enforcement and policy developments are materially shaping risk, infrastructure and market confidence in the crypto sector. Platforms that adopt higher compliance may benefit, while those with opaque practices may face elevated risks.

Trading & Market Movement

Market Snapshot

- According to Binance data: the global crypto market cap was approximately US$3.81 trillion, down ~1.25% over the past 24 hours. (Binance)

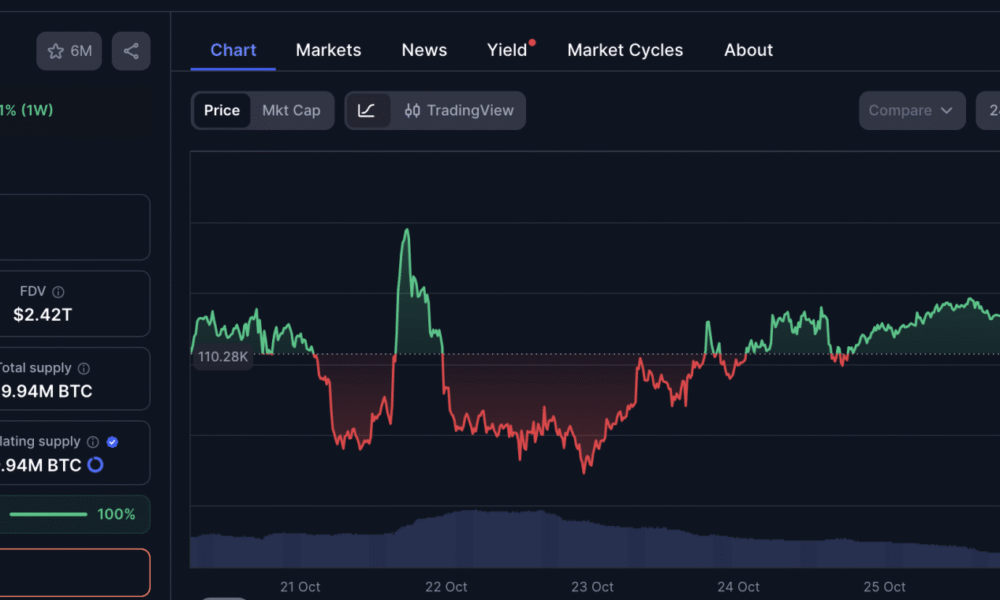

- The Bitcoin price tested the US$110 000 support level following a “sell-the-news” reaction to macro announcements. (CoinDesk)

- Historic liquidations: over US$1.148 billion in cryptocurrency positions were liquidated in the last 24 hours, signalling elevated volatility. (Binance)

What’s driving the action

- A cautious tone from the Federal Reserve regarding future rate cuts combined with a new U.S.–China trade deal triggered risk-off sentiment across crypto markets. (CoinDesk)

- Sharp liquidation numbers mean that leveraged traders are under stress—and market moves may be amplified in either direction.

- Given regulation and enforcement themes prominent this week, investors may be assessing not only price but structural/regulatory risk.

Implications for Investors & Traders

- Short-term risk is high: With liquidations, macro uncertainty and regulatory enforcement all active, volatility remains elevated.

- Medium-term structural opportunities: Clearer regulation, stronger compliance and institutional participation may strengthen the asset-class framework.

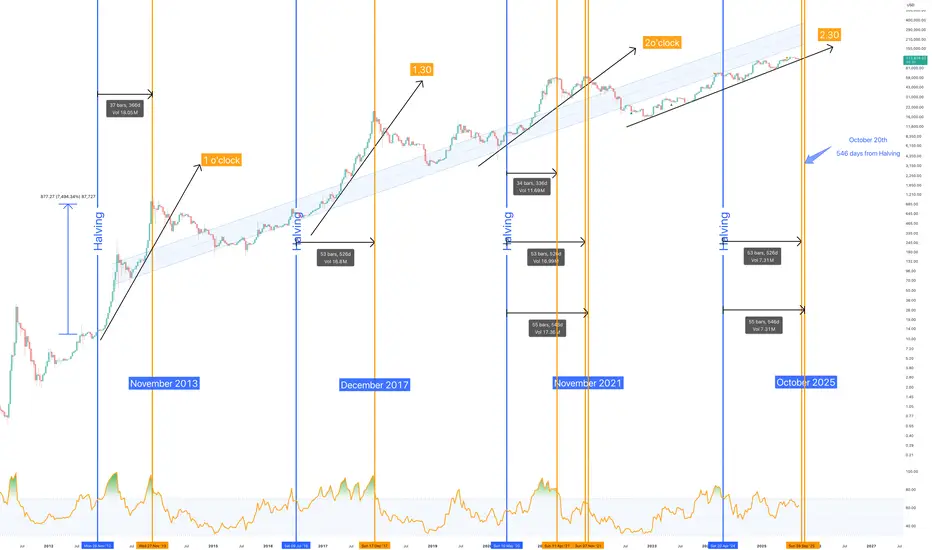

- Watch key levels and sentiment: Bitcoin’s challenge of US$110 000 support, and altcoins’ relative performance, will give clues to directional momentum.

- Diversification and risk management matter: Given the rapid pace of change, allocating only a portion of your portfolio to high-risk assets and being nimble is prudent.

Conclusion

The crypto market sits at another pivotal moment: enforcement and regulation are becoming front-and-centre even as trading dynamics remain volatile. For your readers in the UK and USA, staying ahead of policy change and market structure is just as important as price charts. At Market Financial Journal, we will continue tracking these developments to help you make informed decisions.