Global Oil Producers Hit Pause on Output Hikes as Market Signal Shifts

Introduction

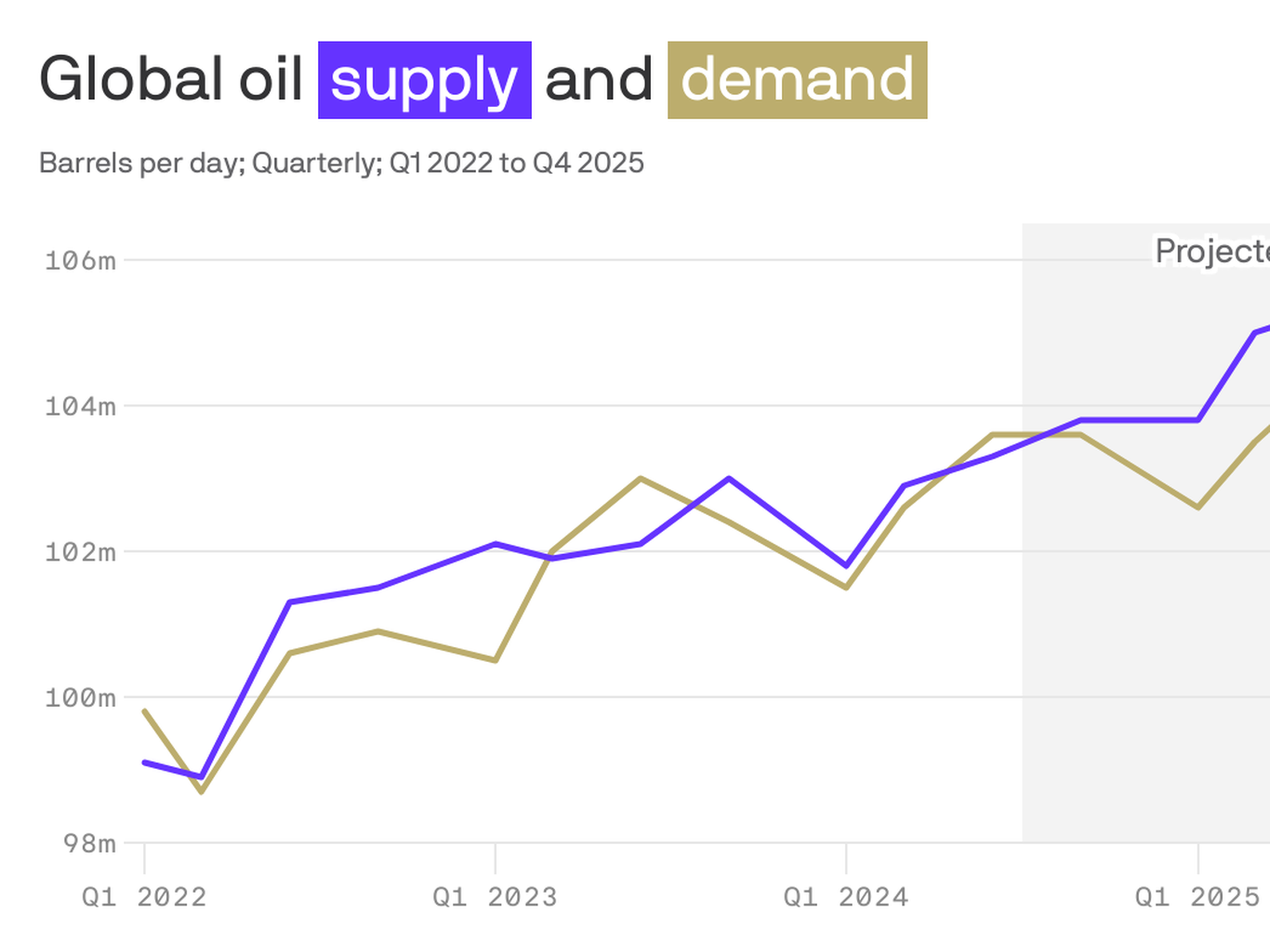

The global oil market has taken a notable turn: the OPEC+ group has agreed to pause further output increases into early 2026, signaling caution amid concerns of oversupply and weakening demand. (Yahoo Finance)

This strategic move carries significant implications for global business, trade flows, investment decisions and the broader energy-cost landscape.

What Happened

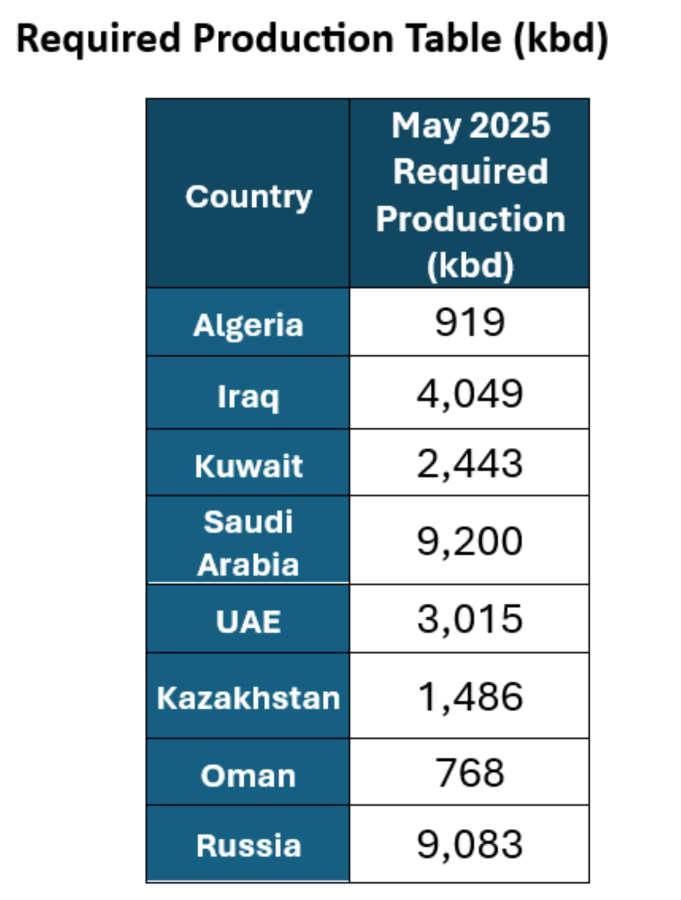

- OPEC+ agreed to a modest output rise in December of about 137,000 barrels per day, but paused additional increases for January through March 2026. (The Economic Times)

- Analysts point to growing risks of a crude supply glut, softer demand (especially in key markets like Asia) and geopolitical/production uncertainties (for example from Russia) as motivating factors. (Politico Pro)

- As a result, Brent crude has traded around the US$64-66 a barrel mark, reflecting both relief and underlying caution. (The Economic Times)

Why This Matters for Business

- Cost pressures & profit margins: Many industries depend on oil as a major input—transport, logistics, manufacturing. Paused output growth may help stabilise prices, but it also highlights that demand may not grow as expected.

- Investment & capital expenditure (capex): Energy-sector players and related industries may delay expansion if demand remains uncertain. Also, investors will reassess valuations of firms exposed to energy cycles.

- Global trade & supply chain: Lower or stagnant growth in demand from major markets may reflect weaker global trade—impacting exporters, commodity-dependent firms and logistics providers.

- Regional implications (UK/USA focus): For UK and U.S. firms, energy stability is critical. A calmer oil market could ease inflation pressures and borrowing costs, but slower energy-driven growth may dampen some sectors.

Key Takeaways & What to Watch

- Watch the price zone: If Brent falls below US$60 (as some analysts forecast) the signal will move from caution to risk-off in energy. (The Economic Times)

- Demand indicators: Pay attention to factory/PMI data in Asia, U.S. inventory reports, and new trade/tariff developments—these will influence whether the pause is temporary or deeper.

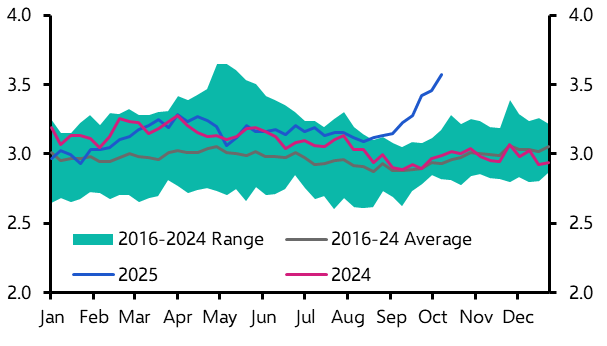

- Policy and sanctions: Actions affecting major producers (e.g., Russia) or global trade flows will matter; for instance, U.S. sanctions on Russian crude are already having effects. (The Times of India)

- Corporate reaction: Energy companies may pre-emptively delay projects or cut costs; firms in other sectors may revise business plans if energy cost assumptions change.

Conclusion

The decision by OPEC+ to pause output hikes is more than a technical adjustment—it signals that global demand and supply fundamentals are shifting. For businesses, investors and strategists—in the UK, USA and globally—this means heightened importance of cost discipline, monitoring energy-linked risks, and staying agile in a changing environment. At Market Financial Journal, we will continue to bring you the developments that matter, when they matter.