Why the Global Economy Is Under the Microscope

Introduction: Why the Global Economy Is Under the Microscope

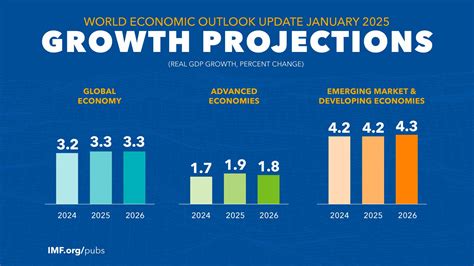

In the latest economy news, growth projections are being revised downward, underscoring how trade tensions, policy uncertainty, and macroeconomic risks are testing global resilience. According to major institutions like the OECD, IMF, and World Bank, 2025 could see more subdued economic performance than previously expected.

Global Growth Forecasts: Slower Pace Ahead

OECD Outlook

- The OECD now expects global GDP growth to slow to 2.9% in 2025 and 2026, citing increased trade barriers, tighter financial conditions, and persistent policy uncertainty. (OECD)

- In its interim March 2025 report, the OECD projected global growth at 3.1% in 2025 and 3.0% in 2026, assuming current tariffs hold. (OECD)

- The OECD warns that higher trade costs will likely feed into consumer prices, potentially keeping inflation sticky. (OECD)

IMF Projections

- In their July 2025 World Economic Outlook, the IMF raised its global growth forecast slightly to 3.0% for 2025 and 3.1% for 2026, reflecting somewhat looser financial conditions and lower-than-expected tariff rates. (The NewsMarket)

- However, the IMF continues to highlight trade policy risks as a major drag on long-term growth. (Al Jazeera)

World Bank Warning

- According to the World Bank’s June 2025 report, global growth is projected to fall to 2.3% in 2025, marking the weakest run (outside of a recession) since 2008. (World Bank)

- The bank points to policy uncertainty and trade tensions as major factors cutting into both developed and developing economies. (World Bank)

Key Risks Weighing on the Economy

- Trade Uncertainty: New or persistent tariffs and geopolitical fragmentation are dampening investment and business confidence. (OECD)

- Policy Risk: Governments face tough choices — balancing inflation control with growth — adding to macroeconomic uncertainty. (OECD)

- Inflation Pressures: While inflation is expected to ease, rising trade costs could keep upward pressure on prices in many regions. (OECD)

- Debt Vulnerabilities: Many emerging markets remain exposed to high debt, and weak growth could worsen their fiscal outlook. (World Bank)

Regional Outlook & Economic Performance

- United States: According to the OECD, U.S. growth is expected to drop significantly, with projections of 1.8% in 2025. (OECD)

- China: The IMF and OECD both expect China’s growth to moderate, reflecting weaker export demand. (OECD)

- Emerging Markets: Growth in emerging economies is being downgraded as capital flows tighten and trade frictions persist. (World Bank)

Why This Matters: Economic Implications for Businesses and Consumers

- Companies may delay investment due to uncertainty, affecting hiring and innovation.

- Consumers could face higher prices if inflation remains sticky.

- Governments may need to adjust fiscal policies to support growth while managing debt.

- Global supply chains might continue to shift as countries respond to trade pressures.

Internal Links (for Your Website)

- For more macroeconomic coverage: See our Global Economy Section

- For trade and policy updates: Browse our Trade Policy & Economy Insights

- For inflation and central bank trends: Visit our Inflation & Monetary Policy page

External References & Further Reading

- OECD’s Economic Outlook press release on global growth projections. (OECD)

- IMF’s World Economic Outlook update, July 2025. (The NewsMarket)

- World Bank’s Global Economic Prospects report, June 2025. (World Bank)

- Euronews analysis on OECD’s warning about trade pressures. (euronews)

FAQs – Economy Outlook 2025

Q1: Will the global economy fall into a recession in 2025?

A1: No, major institutions like the World Bank and IMF do not currently expect a global recession, but they do warn of significantly slower growth. (World Bank)

Q2: What is causing growth to slow down?

A2: Key factors include rising trade barriers, policy uncertainty, and tighter financial conditions. (OECD)

Q3: Is inflation expected to go down?

A3: Yes, headline inflation is projected to decline somewhat, but increased trade costs could keep it higher than central bank targets in some regions. (OECD)

Q4: Which regions are most at risk?

A4: Emerging markets with high debt loads and economies heavily exposed to trade risks are considered particularly vulnerable. (World Bank)

Conclusion

The economy in 2025 faces a more fragile road ahead. While major institutions still avoid recession-level forecasts, the slowdown in global growth highlights how trade tensions, inflation, and policy uncertainty are weighing heavily on economic momentum. Businesses, investors, and consumers must navigate this terrain carefully, as structural risks and geopolitical friction could reshape economic trajectories in the years to come.