Breaking Business Update: The Latest Financial Trends Worldwide

Introduction

The global economy continues to evolve rapidly, and today’s business update brings critical insights from the past 10 hours. Markets around the world have responded to mixed economic data, tech earnings, and fresh policy shifts. Whether you’re an investor, analyst, or entrepreneur, these updates can help you stay informed and ready for tomorrow’s decisions.

Global Market Trends and Reactions

In the latest business update, global indices fluctuated as traders reacted to new inflation data and manufacturing reports.

- The Dow Jones posted modest gains amid solid corporate earnings.

- European markets showed mixed performance due to energy price pressures.

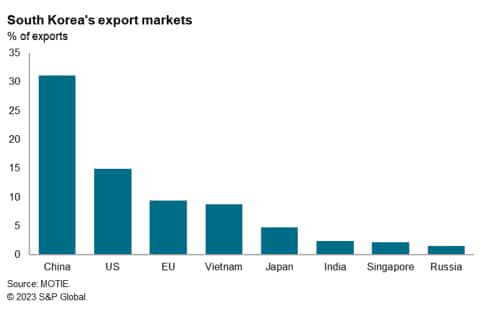

- Asian markets rebounded on strong export figures from Japan and South Korea.

These figures show investor sentiment shifting cautiously positive, signaling a stable yet watchful environment for Q4 investments.

Corporate Highlights and Sector Updates

This business update highlights strong quarterly results from global tech firms, which continue to lead innovation spending.

Financial institutions reported improved margins as digital services gained traction, while energy companies announced new renewable initiatives to meet 2030 sustainability goals.

Key takeaways:

- AI investments continue to dominate corporate budgets.

- Green energy and digital transformation remain top priorities.

- Retail and manufacturing sectors show gradual recovery.

Economic Policy Developments

Government policy decisions remain a key driver of this business update.

The U.S. Federal Reserve signaled caution on interest rates, while the European Central Bank maintained its inflation control stance. Meanwhile, Asian economies introduced new tax incentives for small businesses to strengthen post-pandemic recovery.

Investment Outlook for 2025

Analysts suggest maintaining a diversified portfolio across tech, green energy, and financial services.

This business update underlines investor interest in stable dividend stocks and innovation-led firms as market volatility continues.

Experts also recommend tracking global interest rate decisions closely over the next few weeks.

Read more: Global Economic Outlook 2025 — What Investors Need to Know