1) Blackstone Inc. Makes $705 Million Bet on India’s Federal Bank

A U.S. private-equity giant, Blackstone, will invest approximately ₹61.97 billion (≈ $705 million USD) for a 9.9% stake in India’s Federal Bank via its Singapore affiliate. (Reuters)

- The investment will come via preferential equity shares and warrants, and once complete, Blackstone gains the right to nominate a non-executive director to the bank’s board. (Reuters)

- Finalisation is contingent on regulatory approvals from the Reserve Bank of India (RBI), the Competition Commission of India (CCI), and shareholder consent. The extraordinary general meeting (EGM) to approve the deal is set for 19 November 2025. (Reuters)

- Federal Bank’s stock rose about 1.5% after the announcement. (Reuters)

Why this matters:

- For U.S./U.K. investors: This shows that major Western capital is still entering high-growth Indian banking opportunities.

- For emerging-market strategy: Banking consolidation and foreign institutional participation continue to gain momentum in India.

- Internal link tip: On your site, link to a previous article like “Foreign investment trends in Indian banking 2025”.

- External link: Use the Reuters original article for credibility (see above).

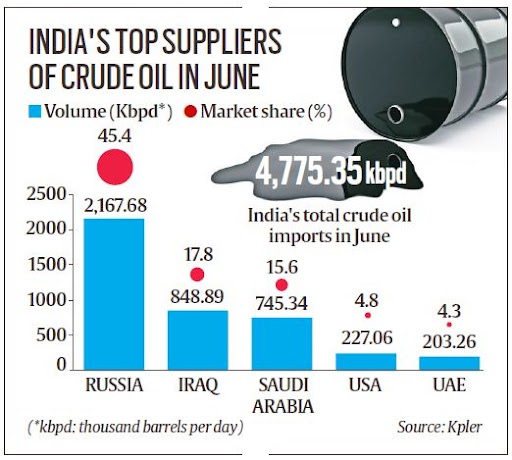

2) India Poised to Slash Imports of Russian Crude as U.S. Sanctions Bite

India’s refiners are reportedly preparing to sharply reduce imports of Russian oil in response to newly imposed U.S. sanctions on Russia’s top oil companies, Rosneft and Lukoil. (Reuters)

- India has been one of the largest buyers of discounted Russian seaborne crude, importing about 1.7 million barrels per day in the first nine months of 2025. (Reuters)

- The move could ease pressure from the U.S. in trade negotiations, where India has faced tariffs partly due to its Russian oil trade. (Reuters)

- Global oil markets are now on heightened alert for supply disruptions, and prices remain sensitive. (Reuters)

Why this matters:

- For the global energy-aware U.S./U.K. reader: a major shift in supply from Russia to India alters pricing dynamics and has inflationary implications.

- For your audience: It underscores how geopolitics and trade policy directly impact commodities and investment signals.

- Internal link: Link to your earlier coverage such as “Impact of U.S. sanctions on global oil flows”.

- External link: Reference the Reuters story above.

3) Sika AG Posts Weaker Sales, Plans up to 1,500 Job Cuts

Swiss industrial-chemicals maker Sika reported a 3.8% drop in nine-month sales (to CHF 8.58 billion), citing a strong Swiss franc and weakening construction demand in China. The company also announced plans for up to 1,500 job cuts and one-off charges of CHF 80-100 million in 2025. (Reuters)

- In local currency terms sales rose 1.1%, indicating the currency translation effect weighed heavily. (Reuters)

- The U.S. remains Sika’s largest individual market (≈ 27% of sales), which for now remains unaffected by key tariffs. (Reuters)

Why this matters:

- For U.S. audience: Even global firms operating in “construction chemicals” face headwinds tied to currency fluctuations and regional slowdown.

- For your site: This is a concrete example of how macro-factors (currency, demand) affect cross-border manufacturing & investment.

- Internal link: Connect to content like “How currency headwinds hit global manufacturing firms”.

- External link: Cite the Reuters piece above.

✅ Key Takeaways for Investors and Business Readers

- Capital flows: Blackstone’s move into Indian banking signals the region remains attractive for global PE even amid macro uncertainty.

- Energy & geopolitics: India’s pivot away from Russian crude underscores how sanctions and diplomacy are reshaping supply chains, with direct implications for oil prices and inflation.

- Industrial stress: Sika’s results highlight that not all sectors are booming—manufacturers must navigate currency risk, weak regions, and restructuring.

🔍 SEO Metadata

- Title: “Blackstone Invests $705 M in India’s Federal Bank | India Cuts Russian Oil Imports | Sika Plans 1,500 Job Cuts”

- Meta Description: “Catch the latest business headlines: Blackstone’s major banking deal in India, India’s move to slash Russian oil imports after U.S. sanctions, and Sika’s sales drop & job-cut plan.”

- Focus Keywords: Blackstone Federal Bank India, Indian Russian oil imports, Sika job cuts 2025, global banking investment India, energy sanctions Russia India

- Slug: major-business-moves-blackstone-india-oil-sika-2025-10-24

- Tags: #EmergingMarkets #PEInvestment #EnergyMarkets #ManufacturingHeadwinds

📩 Contact