Global Economy 2025: Growth Holds Steady, but Global Risks Are Rising

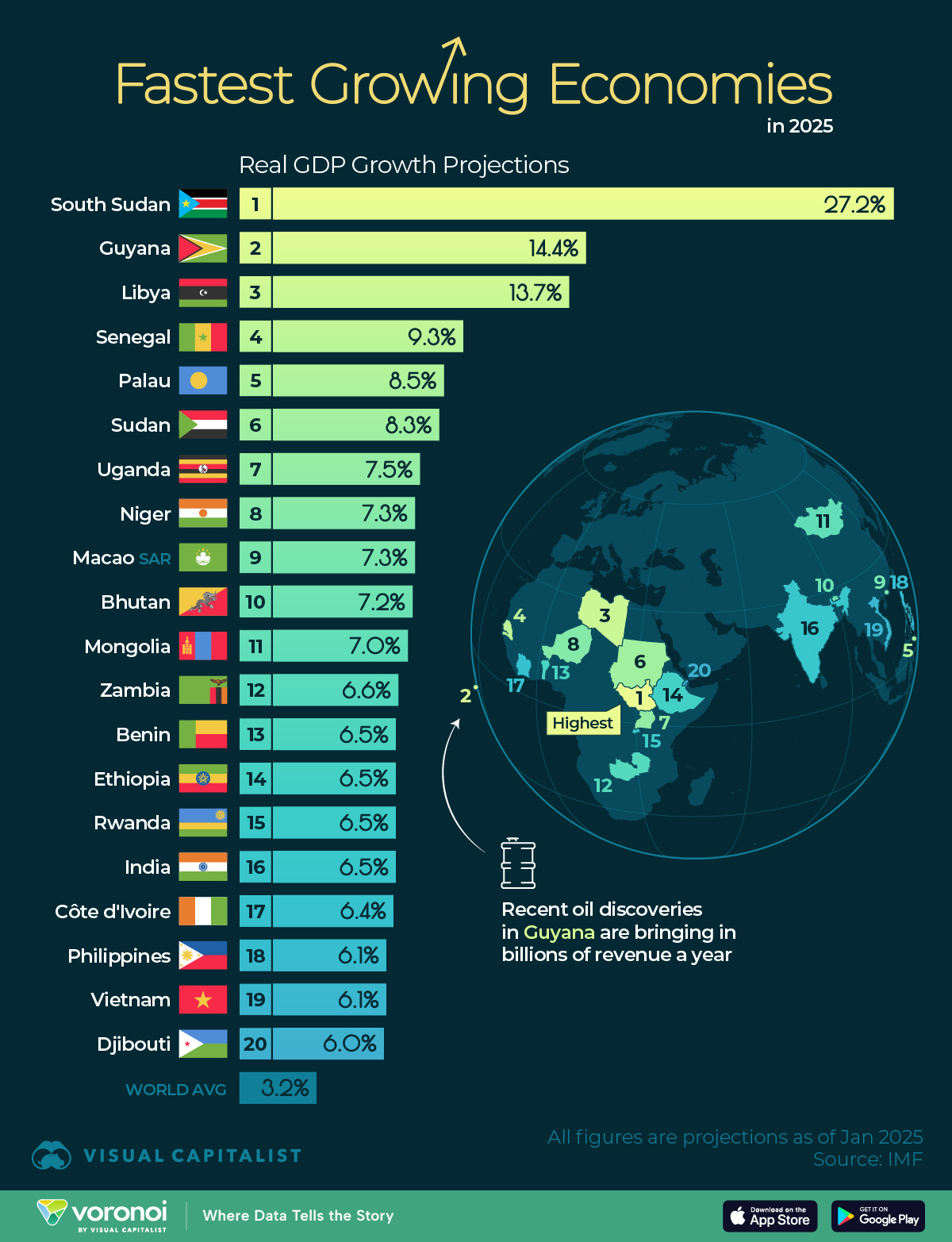

Image Source: Visual Capitalist

The global economy in 2025 stands at a delicate balance — steady, yet surrounded by mounting uncertainty. According to the International Monetary Fund (IMF), the world’s growth rate is projected at 3.0% for 2025, slightly higher than 2024 but still below the pre-pandemic average. (IMF Report)

While inflation pressures are easing, geopolitical tensions, slow productivity, and trade disruptions continue to test resilience in major markets like the United States, United Kingdom, China, and India.

The Forces Driving Growth

Despite global headwinds, several positive trends are supporting moderate expansion:

- Emerging Markets Lead the Charge:

Economies such as India and Indonesia remain the world’s strongest growth engines. India’s GDP is expected to expand over 6%, driven by technology exports, domestic consumption, and infrastructure spending. (FICCI Economic Outlook) - Cooling Inflation:

Inflation rates in advanced economies are now returning closer to target levels — averaging 2.8% in 2025 versus over 5% two years ago. This has allowed central banks such as the Federal Reserve and Bank of England to pause rate hikes. - Digital Transformation:

The rise of AI and automation is boosting productivity in some sectors, particularly finance and healthcare. Global investment in digital infrastructure is expected to surpass $1 trillion by the end of 2025.

The Storm Clouds Ahead

Image Source: NatWest Insights

- Trade Barriers and Fragmentation

Protectionism is rising. The OECD warns that escalating tariff disputes could cut global output by up to 0.5% annually. (The Guardian)

U.S.–China tensions remain a key drag on supply chains and corporate confidence. - Debt and Fiscal Pressure

Global debt has soared to over $310 trillion, with many developing nations struggling under higher borrowing costs. (Business Standard)

This limits governments’ ability to spend on growth-supportive projects such as infrastructure and energy transition. - Weak Productivity and Labour Market Mismatches

Even as employment remains high, productivity growth in Western economies has slowed dramatically. This means companies are hiring more but producing less — a worrying signal for long-term prosperity. - Energy Uncertainty

Recent U.S. sanctions on Russian oil have reshaped global energy flows. India and Turkey — two of Russia’s top buyers — have reduced imports, tightening supply in other regions. (Reuters)

What It Means for Businesses and Investors

The combination of moderate growth and high volatility creates a challenging landscape:

- For Businesses:

Firms must prioritize efficiency, cost control, and diversification of supply chains. Adopting automation, data analytics, and AI tools will be essential to stay competitive. - For Investors:

Volatility will define 2025. Stable returns may come from defensive sectors like healthcare, renewable energy, and consumer staples. Meanwhile, emerging markets — particularly India and Vietnam — remain attractive for long-term growth. - For Policymakers:

Governments face the dual task of sustaining growth while managing debt. Strategic public spending and global cooperation will determine whether 2025 becomes a stabilizing year or a prelude to slower times ahead.

Global Outlook: U.S., U.K., and Asia

- United States:

The U.S. economy continues to expand modestly at around 2% growth, supported by strong consumer demand and AI-driven productivity. However, high credit card debt and tight labor markets remain concerns. - United Kingdom:

The U.K. faces a sluggish recovery, with growth forecast at 1.3%. Inflation remains sticky, keeping pressure on the Bank of England to maintain a cautious monetary stance. - Asia:

Asia continues to anchor global growth. India, Indonesia, and the Philippines remain bright spots, while China’s recovery remains uneven due to its property market slowdown.

Measuring the Global Pulse

Key metrics to watch in the coming months:

- Central bank interest-rate decisions

- Global trade volume trends

- Corporate earnings outlooks in Q4 2025

- Emerging-market capital flows

- Oil and commodity prices

Contact:

- Gmail: hammadyousaf355@gmail.com

- LinkedIn: Raja Hammad Khan

- 🌐 Visit: Market Financial Journal