In a significant turn of events, the Trump administration’s new sanctions on Russia’s two largest oil companies — Rosneft and Lukoil — have already begun to ripple through global energy markets. According to Reuters, Indian refiners are now reducing or halting imports of Russian oil to avoid violating the latest U.S. sanctions, signaling an early victory for Washington’s strategy to isolate Moscow’s energy exports.

India Reacts to U.S. Sanctions

Reliance Industries Ltd., India’s largest private refiner and a major importer of Russian crude — controlled by billionaire Mukesh Ambani — is reportedly planning to cut or completely stop buying Russian oil, according to industry sources cited by Reuters.

State-run refiners such as Indian Oil Corporation (IOC) and Bharat Petroleum Corporation Limited (BPCL) are also adjusting procurement plans to ensure that no supplies are sourced directly from Rosneft or Lukoil, the companies now under fresh U.S. restrictions.

Why This Development Matters

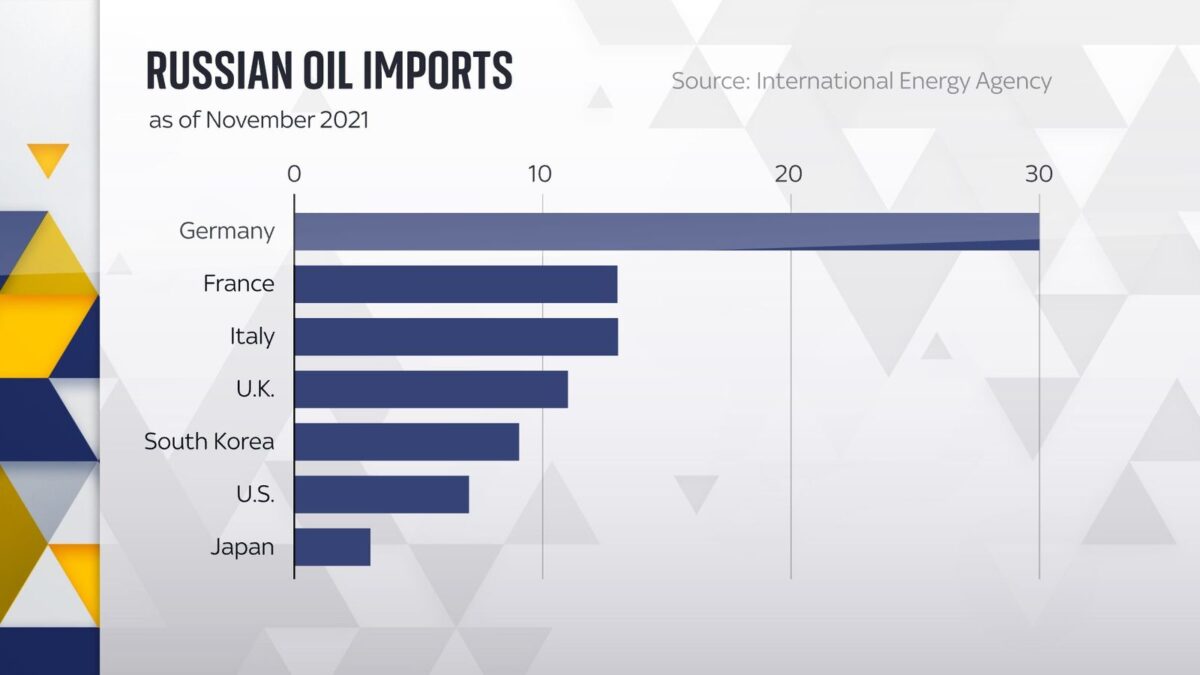

India has been one of the largest importers of discounted Russian oil since the Ukraine conflict began. The decision to curb these imports represents a major geopolitical and economic shift that could reshape global oil supply chains.

According to RBC Capital Markets, Rosneft and Lukoil together account for nearly half of Russia’s total oil exports. Any disruption in their global trade could have far-reaching effects on crude prices, refinery operations, and energy market stability.

Impact on Global Oil Prices

The new sanctions could potentially dent Russia’s oil revenue, which remains a key source of funding for its economy. However, analysts warn that this move might also tighten global oil supply, pushing prices higher as countries like India compete for non-Russian crude.

Energy strategist Helima Croft of RBC Capital Markets noted, “Prior to this point, U.S. policy had been designed to avoid a serious Russian supply disruption.” She emphasized that such disruptions could now elevate global oil prices, increasing inflationary pressures worldwide.

Energy Market Outlook

The global oil market is already facing volatility due to production cuts by OPEC+, rising tensions in the Middle East, and increasing demand recovery in Asia. The latest U.S. sanctions add another layer of uncertainty that could reshape trade routes, especially for Asian economies dependent on affordable Russian crude.

Market analysts predict that Brent crude prices could rise if India and other major importers shift away from Russian supplies. Meanwhile, Russia may turn to China and smaller regional buyers to offset the loss of Indian demand.

Conclusion

The U.S. sanctions on Russia’s oil giants are already creating tangible effects in the energy sector. As India adjusts its import strategy, the global oil market is bracing for potential price surges and supply realignments.

For investors and policymakers, this development highlights how geopolitical sanctions can reshape global energy flows and influence economic stability far beyond the intended targets.

Contact: